At first glance, this may sound complicated. But don't worry: There are ways to easily optimize your finances and thus take the first step towards financial freedom and generating more income.

One way to get your finances in order in your life could be a plan that gives you an overview of your financial situation at any given time.

With my appropriate advice I will relieve you of your unnecessary financial burdens.

It is a financial model of a multi-account strategy for different areas in which you allocate your income.

There are many different account models that financial analysts have developed.

Not all models are suitable for everyone. You should choose the one that is most accessible to your situation.

Don't let all of this scare you... that's where I take over with transparency and no hidden costs to help you choose the model that fits you and gets you closer to financial freedom!

Below I have prepared several economic models so you can find out which one suits you best. If you have any questions, please do not hesitate to contact me.

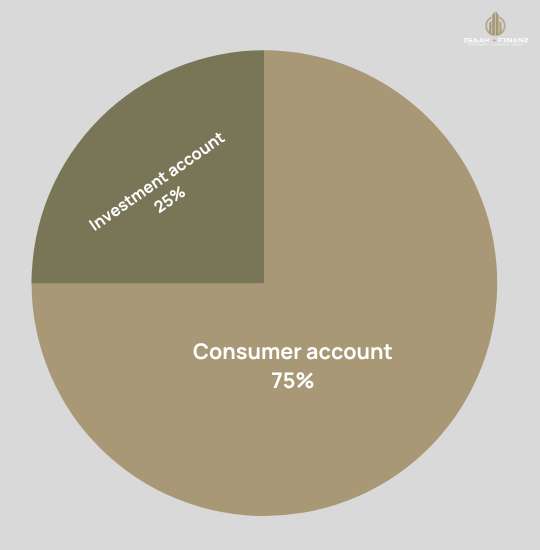

With the No2 model, you have a consumer account and a savings/investment account. You put a maximum of 75% of your income in the consumer account. The rest goes into your investment account, which you use to build assets and save for larger purchases. Because of its simplicity, this model is our favorite.

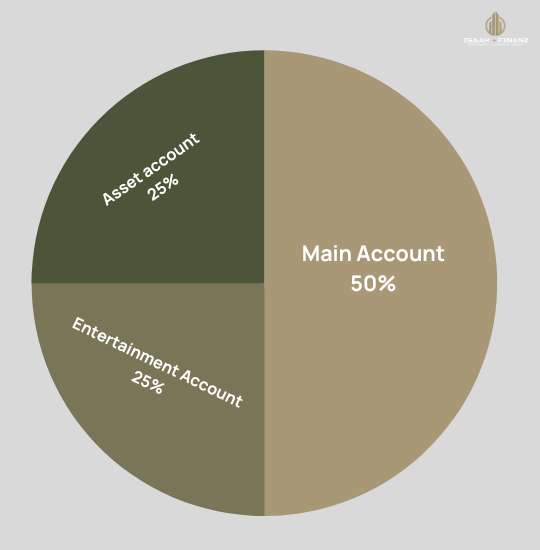

Model No3 consists of a main account, an entertainment account and an asset account. The main account has 50% of your income, which you can spend on all the day-to-day things you need to live on. The rest is split between the entertainment account (holidays, parties, etc.) and the asset account. Watch out: At least 25 percent of your income should go into your assets account, which is preferably larger than the entertainment account.

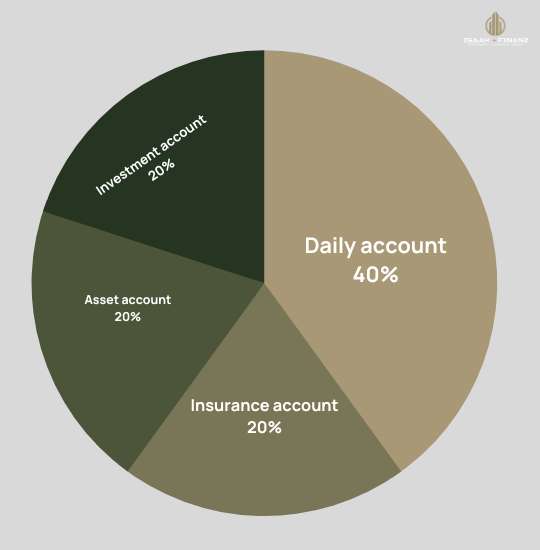

Model No4 does not have fixed quotas. Here, everyone has to decide how much money they want to spend on which of the four accounts. There is the daily account for essential and daily consumption, the insurance account for emergency, the asset account which should always contain at least 3 to 6 monthly incomes, and the investment account for old age provision.

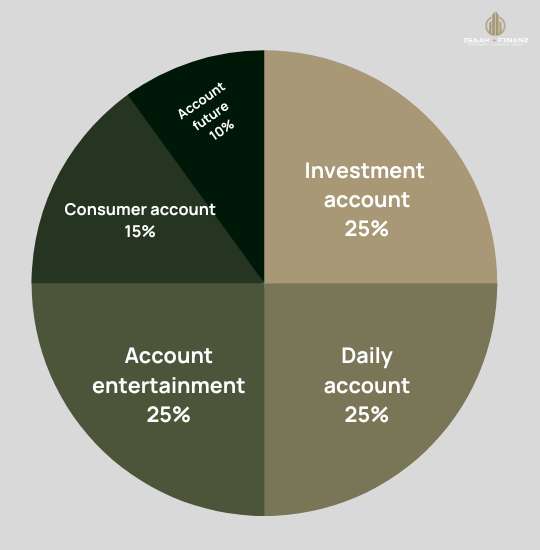

In the No5 model there is also a daily account for your needs. In addition, you should have a consumption account for non-daily but necessary purchases and an entertainment account for whatever makes your life sweeter. Your future is in focus and takes care of your old age provision with ETFs and the investment account for riskier investments, for example equity in a company. And, here, in the No5 financial model, there are no fixed rates.

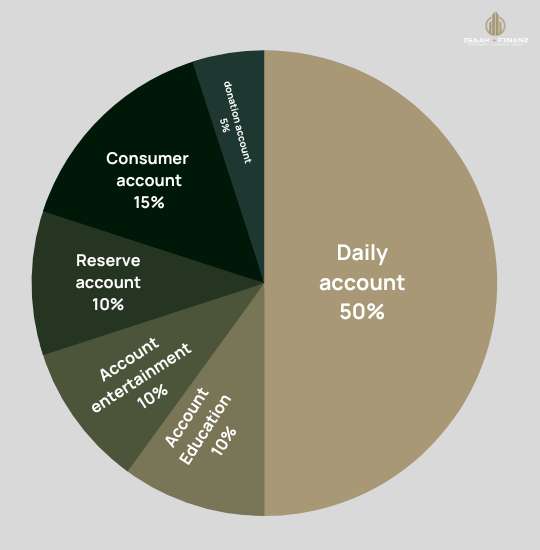

With model No6 you distribute your income as follows: A maximum of 50% of your income remains in your daily account for your living expenses. You allocate 10% each to a reserve account for larger, unplanned expenses, an entertainment account, an education account and a savings account for old age provision. You put the remaining 5% into a giving account that you can use to make the world a better place.

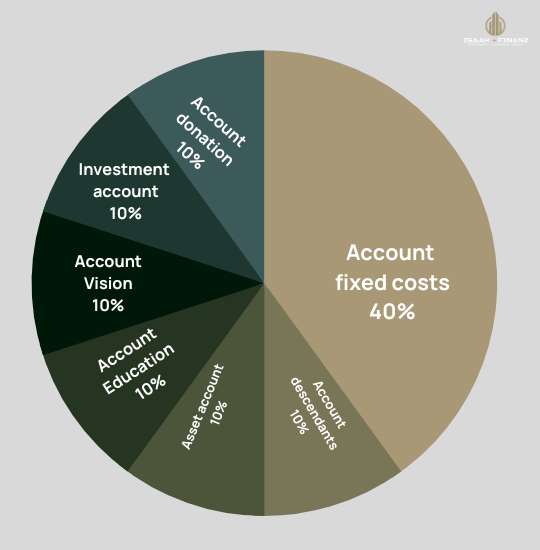

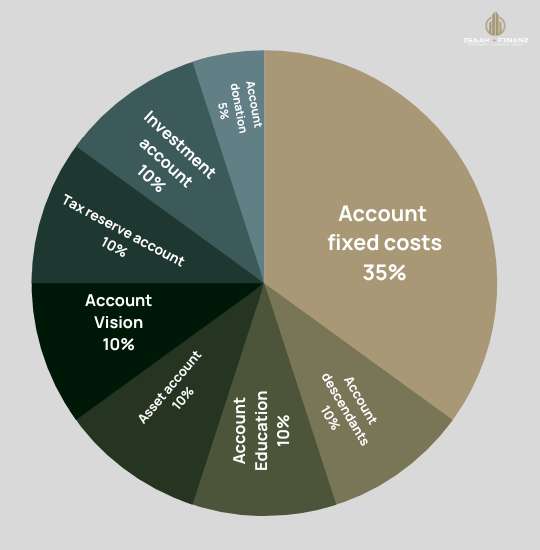

In model No7 there is one account for fixed expenses, one for investments, one for education, one for your pleasure, one for donations, one for your visions and one for your descendants. 40 percent of your income is reserved for the fixed expense account, 10 percent is allocated for all other accounts.

Admittedly, it’s not easy, but it can be done. Contact me to check which one suits you best!